Tuli's

Tuli's® So Soft® Heavy Duty Heel Cups

Choose options

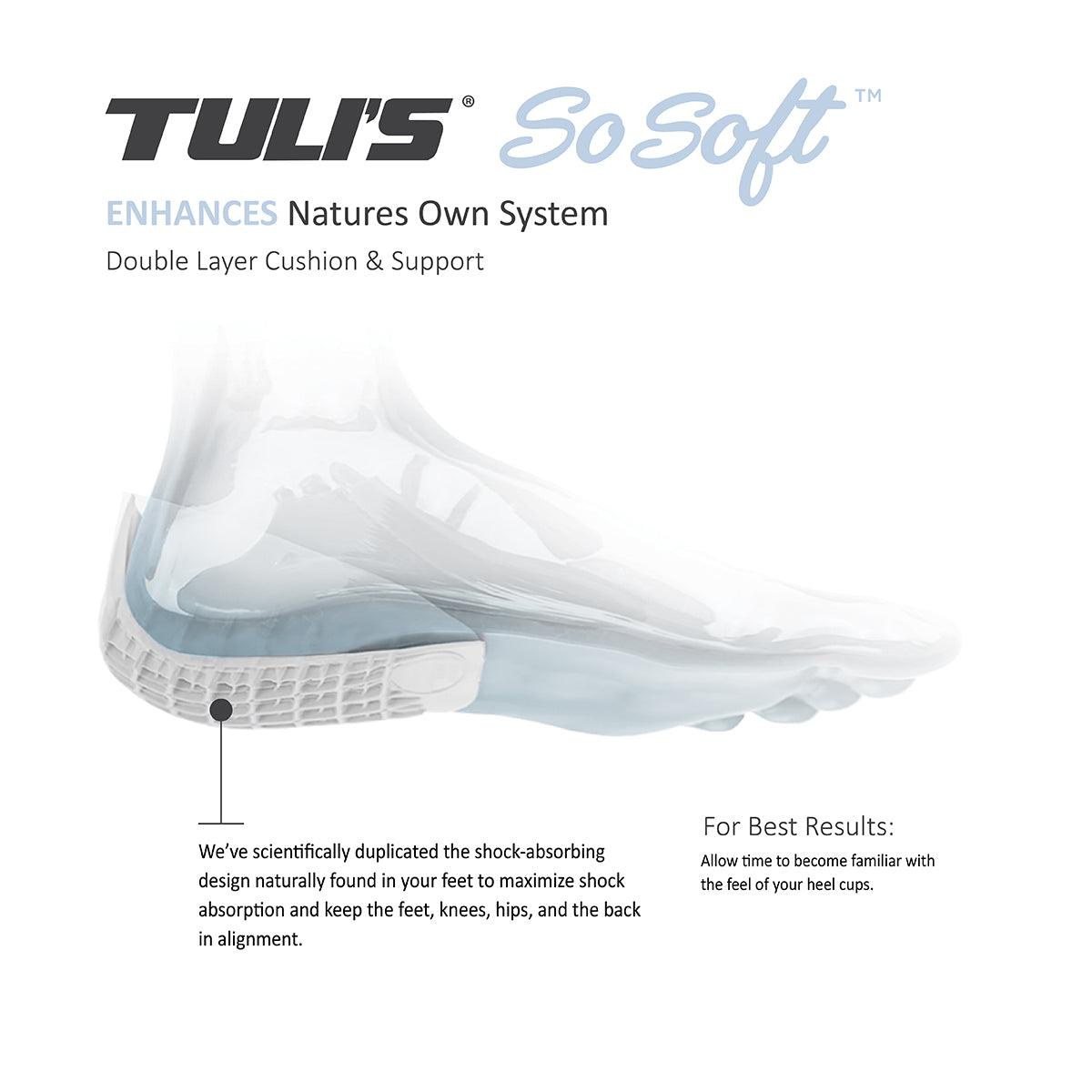

Tuli's® So Soft™ Heavy Duty Heel Cups are exclusively formulated to be lighter, softer and more resilient than other heel cups. Soft cloth material combined with softer heels means better shock absorption and increased comfort with or without socks.

Nothing works better or lasts longer than your Tuli's® Shock absorbers for your feet.®

The multi-cell, multi-layer design absorbs shock and returns impact energy just like the system naturally found in your feet. This shock absorption and elevation of the heel bone provide immediate heel pain relief and assist in long-term healing. The patent-pending Tuli's So Soft Heel Cups include added comfort of a soft cloth heel bed and a low-profile heel backing so it is easily worn in almost any shoe.

Features and Benefits:

- Soft Fabric Lining - reduces the occurrence of sweat and provides added comfort with or without socks.

- Low-profile Backing - allows for ease of placing and wearing in almost any shoe.

- Multi-cell, Multi-layer Design - absorbs shock and returns energy for immediate relief.

Best Used for: Athletic shoes, cleats, work boots, and spacious lace-up shoes

For Best Results: Allow time to become familiar with the feel of your heel cups.

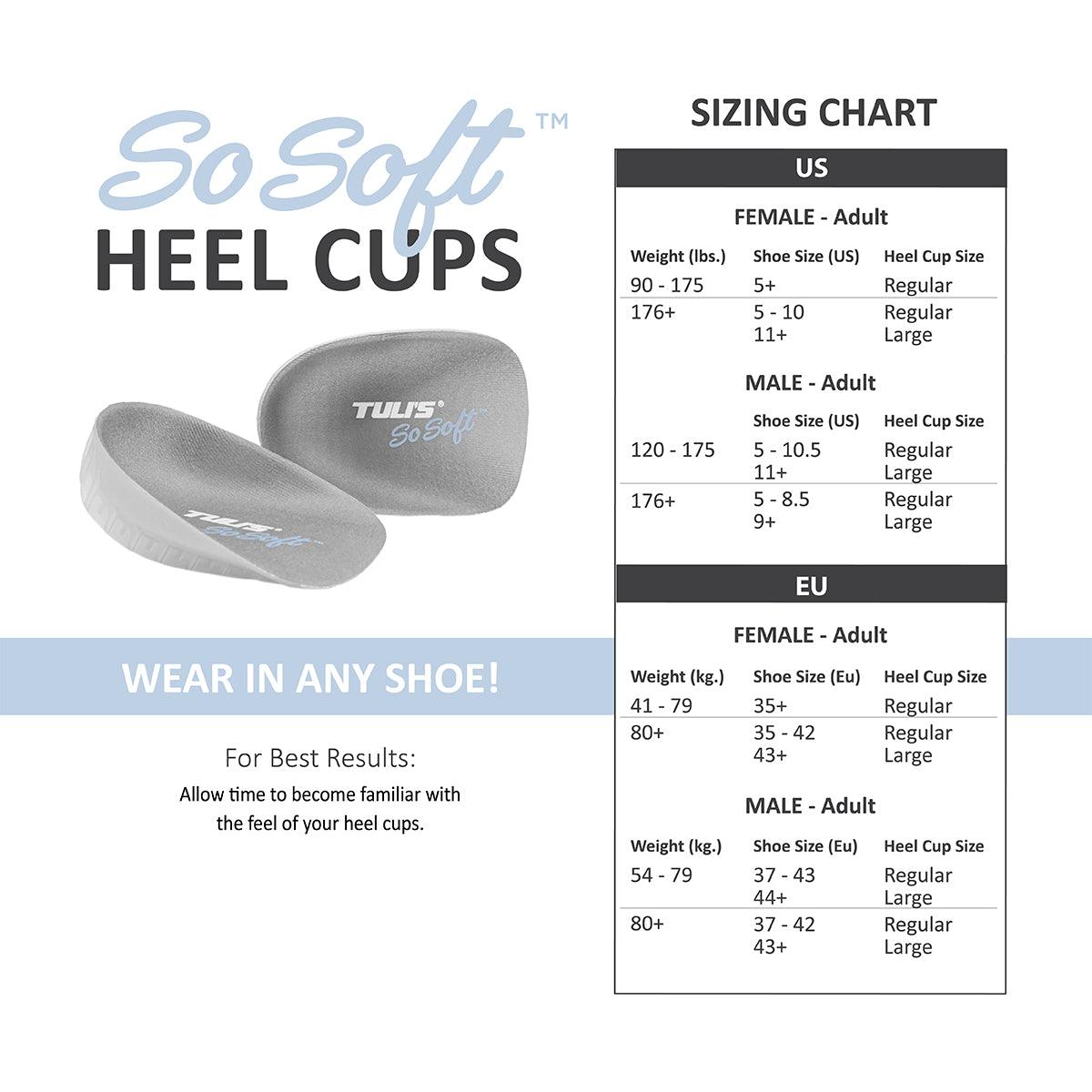

Size Chart: US

| ADULT - FEMALE | ||

| Weight (lbs.) | Shoe Size (US) | Heel Cup Size |

| 90 - 175 | 5+ | Regular |

| 176+ | 5 - 10 11+ |

Regular Large |

| ADULT - MALE | ||

| Weight (lbs.) | Shoe Size (US) | Heel Cup Size |

| 120 - 175 | 5 - 10.5 11+ |

Regular Large |

| 176+ | 5 - 8.5 9+ |

Regular Large |

Are Tuli's So Soft Heel Cups sold as a pair?

Yes. Tuli's So Soft comes with two heel cups.

Are the Tuli's So Soft Heel Cups made of hard plastic?

No, all Tuli's So Soft Heel Cups is made from a soft gel but supportive material.

How much of a lift do the Tuli's So Soft Heel Cups have?

The Tuli's So Soft Heel Cups have up to a 1/4 inch lift depending on impact and weight.

Do you wear the Tuli's So Soft Heel Cups on the inside or outside of socks?

The Tuli's So Soft Heel Cups are best worn outside of socks.

Do the Tuli's So Soft Heel Cups contain latex?

Tuli's So Soft Heel Cups are latex-free.

Do I really go by weight for heel cup sizing? What if I am overweight but have small feet or if I am underweight but have large feet?

Most people can go by their weight and shoe size, however if your feet are larger or smaller than you believe is standard for your weight, we recommend you ordering accordingly.

Can you wear Tuli's So Soft Heel Cups with orthotics? Does the heel cup go on top of or underneath the insole?

Yes, but it is recommended to wear one or the other. If you prefer to wear both, the heel cup should be placed on top of the orthotic.

Do I need to wear heel cups in both shoes?

Yes, to ensure proper balance, always wear Tuli's heel cups in both shoes.

Should the heel cup move in my shoe?

No, if the heel cup moves in your shoe, either your shoe or the heel cup is the wrong size or the shoe may not be suitable for a heel cup.

Can I clean my pair of Tuli's So Soft Heel Cups?

Tuli's So Soft Heel cups may be hand washed with warm water and mild soap. Air dry.

What do the numbers on the bottom of the Tuli's So Soft Heel Cups mean?

These numbers on the bottom of our heel cups are associated with the manufacturing process and have nothing to do with size.

HSA/FSA Questions:

What is Flex and what is their relationship with Medi-Dyne?

Medi-Dyne has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to buy Tuli's So Soft Heavy Duty Heel Cups with pre-tax dollars, resulting in net savings of 30-40%, depending on your tax bracket.

How do I pay with my HSA or FSA card?

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

What if I don’t have my HSA/FSA card available?

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

Why can’t I see Flex as a payment method? (For Shopify Partners only - please remove this italicized blurb when adding to FAQs)

The key here is to make sure you are logged out of ShopPay. One of the easiest ways to do this is to go through checkout in an incognito window.

Why is my HSA/FSA card being declined?

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance.

I submitted my Flex itemized receipt for reimbursement and my FSA requires more information.

Please forward us the request from your FSA, and we will work with the Flex team to issue you a new receipt.

Help! I didn’t receive an email from Flex with my itemized receipt and/or letter of medical necessity. What should I do?

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order.

I would like to use multiple HSA/FSA cards to pay for an item. Can I do that?

No, unfortunately, this isn't a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

My purchase receipt from Medi-Dyne has a different number than what my FSA was charged. How can we resolve it?

Thanks for reaching out, and apologies for the discrepancy. We'll review the charges and get back to you with details of the likely refund shortly.

Is sales tax covered by HSA/FSA funds, or is it treated separately?

Sales tax for eligible items is also covered by HSA/FSA funds. If the customer has a split cart, the tax will be divided among the cards based on the items.

HSA/FSA Reimbursement Questions:

My HSA/FSA Claim was denied. What should I do?

We strongly recommend checking with your HSA/FSA provider to see if a purchase is eligible prior to completing the purchase. However, if you believe your claim has been wrongly denied, please send over any response from your HSA/FSA provider to us so we can share it with Flex and receive guidance on the next best steps to take. Please note that employer-sponsored FSAs can determine what products are eligible beyond the IRS’s guidelines, so it’s extremely important to check prior to purchase.

Can a customer purchase a product now and apply for FSA reimbursement in the next calendar year?

The ability to apply for FSA reimbursement in a future calendar year depends on the policy of the specific FSA provider. Most FSA administrators require that the purchase be made during the time of coverage. For example, if the FSA coverage is for 2025, all purchases typically need to be made and/or submitted for reimbursement within that coverage period.

However, some administrators may have more flexible rules regarding the timing of when the expense occurred. We recommend that customers review their plan policy to confirm the details.

Note: Health Savings Accounts (HSAs) are different and generally allow for reimbursement at any time, even in future years.

Can old (non-Flex) customers use their order confirmation email to apply for HSA/FSA reimbursement?

Unfortunately, for purchases made without using Flex in the checkout to receive an itemized receipt, it may be difficult to apply for reimbursement.

For Health Savings Accounts (HSAs), consumers can use an itemized receipt for reimbursement anytime after they have made the purchase, even if it is many years later.

For Flexible Spending Accounts (FSAs), most accounts require that the purchase was made in the calendar year during which the consumer had the FSA, as FSAs typically do not roll over. Some FSAs offer a buffer window, allowing customers additional time to submit receipts for expenses incurred during the previous calendar year.